- 5 min read

- Aug 1, 2023

- 0

Nowadays, different financial institutions are embracing the concept of open banking. Application programming interfaces enable fintech companies and banking institutions to streamline their daily operations. Robust APIs are used for developing fintech applications that provide transparent alternatives to account holders. Fintechs and financial institutions are widely adopting open banking sectors to come up with ways in which banking APIs can serve their sector. In this blog post, we are going to delineate the advantages of using APIs, their use cases, and how the fintech sector is harnessing its usability.

Unveiling banking APIs

API is the short abbreviation of the Application Programming Interface. It is delineated as a set of conventions and codes determining the ways distinct programming software and is mostly used for imparting distinctive programming applications to another. As a result the wide use of open banking has become standard for giving orders to distinct third-party API service providers. As a result of the widespread adoption of API platforms for connecting developers to payment network systems in addition to displaying billing details on websites of financial institutions.

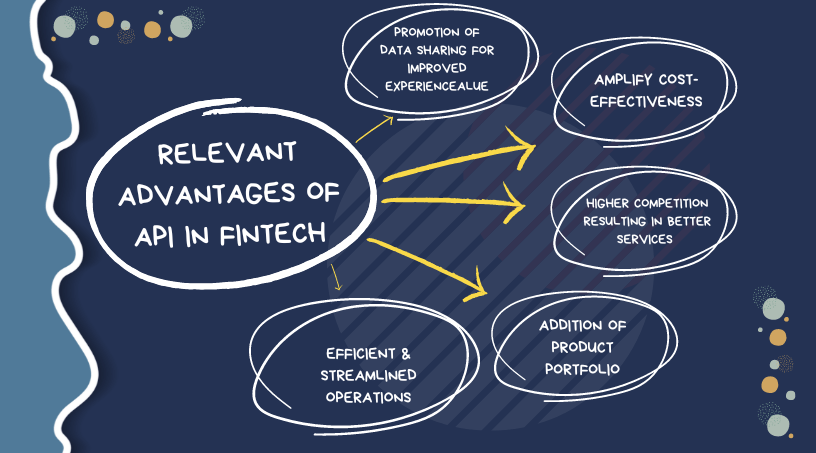

Relevant advantages of API in fintech

A number of benefits of API have made it one of the most powerful tools for fintechs and banking institutions. In this context, let’s take a look at the different advantages of API in Fintech.

Promotion of data sharing for improved experience

During the previous times, banks were keen on sharing user data. However, this is not the present scenario. Nowadays, users want to have full access to data and demand banks to enable data to be shared with desired third-party providers through open APIs.

Amplify cost-effectiveness

At the time of providing an array of distinct banking solutions, they find it difficult to limit costs. This can be achieved by robust API development by experienced developers who have many years of proficiency in confronting different project challenges. API platforms adopted by fintech sectors assist in saving cost as well as time.

Higher competition resulting in better services

The rise of APIs has increased the competition in the market to the advantage of customers. As a result of this, the budget in the economic industry is having access to facilities that are available in distinct branches. With higher competition going on, it was important for financial organizations to stay ahead of the competitive curve. This resulted in enhanced services from banking companies trying to stay ahead of the competitive curve.

API in fintech

In recent times, fintech app development has become one of the most beneficial development procedures to be implemented in the financial industry vertical. and has a low possibility of API in the banking industry becoming obsolete. A large number of businesses are striving to provide better services through API integration platforms.

Addition of product portfolio

Nowadays, API in banking sectors are extending their portfolio of growing products by enabling them to provide complementary products including in partnering with financial tech firms. The flexibility of APIs connecting diverse networks and administering exchange across industry verticals has resulted in this kind of portfolio growth. Some financial institutions are utilizing API platforms to provide non-economic products besides financial items.

Efficient & streamlined operations

With the implementation of API-empowered methods and strategies, fintech firms are capable of efficiently providing users with a seamless experience. APIs enable clients to manage banking transactions through online banking, mobile banking and e-wallet services from any place. They don’t need to physically visit banks as they can process their services through APIs.

API banking use cases in the fintech sector

Currency exchange in peer-to-peer currency exchange

One of the popular use cases of API in the fintech sector involves P2P network systems and payment applications rendering different ranges of services. From currency exchange to purchasing and selling currencies, fintech companies leverage the benefit of API platforms for financial transactions. For instance, fintech app platforms provide tools and ensure open APIs independent of providers that enable many banks to integrate systems with existing operations. P2P platforms are serving as a boon for fintech sectors helping in connecting borrowers and lenders with others to execute searches, perform orders, configure lending portfolios and many more.

Comparison of price

Several popular price comparison websites have adopted API in the fintech economy to become a direct online distributor of financial products. It comprises API service layers to empower its websites and enable commercial partnerships for growth.

Development of API market platforms

API market platforms have made it easier for developers to build a partnership with banks for commercial opportunities. Nextbrain is a leading Fintech app development service provider having a core team of experienced developers creating effective API platforms for financial and banking institutions.

Investment management APIs

Prior to open banking, it was difficult for financial institutions to collect client data for rendering optimized services. Investment management APIs provide access to the portfolio information of individuals.

Smart contracts

The decentralized applications address a changed outlook where apps are implemented through a P2P network using smart contracts. For instance, an office biometric can connect with an API to confirm the user’s credentials.

Forthcoming instances of API in the banking sector

API is becoming majorly popular in the fintech industry. Several fintech startups and enterprises are looking for methods to streamline their functionalities. API platforms can become a life-saver helping in streamlining banking operations. In the future, banking APIs can assist banks in connecting with ecommerce websites benefitting the process of online payments.

Conclusion

Are you looking to create effective API financial solutions? It is relevant to choose the right Fintech software development company. At Nextbrain, professionals create effective API platforms for financial institutions and fintech platforms. The developers have expert knowledge and technical skills in developing professional fintech applications. Connect with professionals to know more about fintech apps.